Understanding the Basics of Packaging HS Code

When diving into the complex world of international shipping and trade, understanding the significance of the packaging HS code is essential. This unique code serves as a universal language facilitating global commerce. The Harmonized System (HS) is a standardized numerical method of classifying traded products and is used by customs authorities around the world to determine the tariffs and taxes for each product.

At its core, the HS code for packaging products is a ten-digit number used to identify the material type, usage specifications, and the product's level of processing. The first six digits are internationally recognized and used by all participating countries, while the remaining digits are country-specific, allowing for more detailed classification.

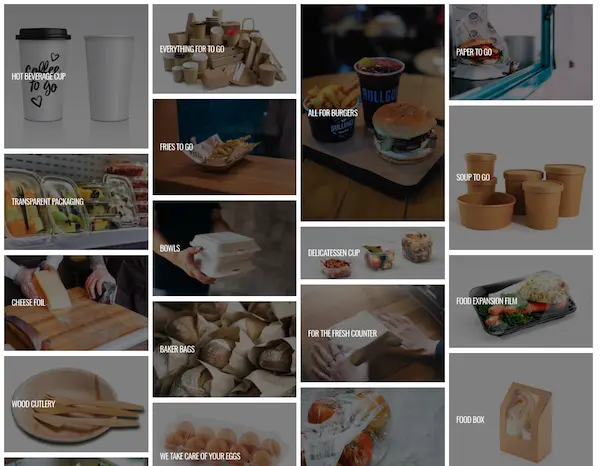

With our network with packaging suppliers along with a huge international network, we provide customizable logistic packaging services as per the needs and requirements of our clients, in order to maintain continuous product development and greatly reduce the spending for packaging solutions.

For businesses involved in the production or distribution of packaging materials, grasping the packaging HS code is vital. Not only does it affect the cost of importing and exporting due to tariffs, but it also ensures compliance with trade regulations, preventing costly fines or delays in shipment.

What is a Harmonized System Code?

A Harmonized System Code, or HS code, is an internationally standardized system of names and numbers for classifying traded products. Developed by the World Customs Organization (WCO), the system helps in harmonizing customs and trade procedures, thereby facilitating the international transport of goods.

HS codes are composed of six digits, with each set of two digits signifying a specific layer of categorization. The first two digits represent the chapter the goods are classified in, the next two provide details on the heading within that chapter, and the final two signify the sub-heading. 1

Using standardized codes promotes consistency and simplifies the process of determining import duties, compiling trade statistics, and conducting risk assessments and other customs controls.

Businesses involved in global trade must accurately assign an HS code to their products, as this affects not only tariffs but also the application of trade policies, monitoring, and quota controls. Misclassification can result in significant penalties or issues with customs clearance, making it crucial for companies to stay informed about the correct coding of their goods.

The Importance of HS Codes in International Trade

HS codes play a pivotal role in international trade by streamlining customs procedures and enabling countries to apply appropriate tariffs and trade policies. With a universally understood system, HS codes minimize the potential for language barriers and misunderstanding among traders, customs officials, and freight forwarders.

These codes are integral for the collection of international trade statistics, serving as a basis for customs tariffs and for the compilation of trade data. This information is critical for government agencies to monitor controlled goods, evaluate the economic health of the nation, and frame foreign trade policies.

Furthermore, the uniform structure of HS codes supports efficient supply chain management. It allows shippers and buyers to forecast costs and processing time, reducing the risk of unexpected expenses. By leveraging accurate HS codes, businesses can ensure predictable duty rates, benefit from international trade agreements, and maintain compliance with regulatory requirements.

In summary, the use of HS codes enhances transparency and efficiency in global commerce. For packaging products, these codes ensure that the materials used adhere to international standards and regulations, which is vital for the protection of consumers and the environment.

How to Find the Correct Packaging HS Code

Finding the correct packaging HS code is a crucial step for businesses to ensure they comply with international trade regulations. The first step usually involves consulting the HS code directory, which is published and maintained by the World Customs Organization. This comprehensive directory provides detailed descriptions and classifications for a plethora of goods.

- Product Description: Start with a detailed and accurate description of your packaging product, including materials, purpose, and any other defining features.

- HS Code Directories: Use online databases or printed directories from customs or trade authorities to match your product description to the appropriate HS codes.

- Consult Experts: Engage with a customs broker or a trade compliance specialist, especially if your product falls into a category with nuanced distinctions.

- Customs Rulings: Look at past customs rulings for similar products to see how they were classified. Many customs administrations publish these rulings online.

- Use Tools and Resources: Utilize classification tools and services offered by freight forwarders or third-party logistics providers.

It may also be beneficial to review the TARIC database if exporting to the European Union, as it provides additional detail related to EU-specific regulations.

Remember, while the first six digits of the HS code are generally the same worldwide, the last four digits can differ by country, reflecting specific national categorizations or policies. Always confirm the full 10-digit code with the importing country's customs authority.

Note: Accurate HS code classification can be complex, especially for packaging materials that can serve multiple purposes. If doubt remains after using available resources, it is advisable to seek official classification from customs authorities to avoid costly errors.

Deciphering the Structure of HS Codes for Packaging

Deciphering the structure of HS codes for packaging entails breaking down the complex layers of classification. Each HS code consists of a series of digits that correspond to specific product attributes defined within the larger HS nomenclature.

For example, consider an HS code such as 3923.21.00:

- The first two digits (39) identify the chapter for plastics and articles thereof.

- The next two digits (23) represent the heading for articles for the conveyance or packing of goods.

- Following this, the subsequent two digits (21) correspond to the sub-heading, which in this case, could specify a particular type of packaging made from plastic.

It's crucial to note that an additional two to four digits may be added beyond the six-digit standardized format to provide even finer classification within individual countries. The complete HS code enables customs officials to apply precise duty rates and determine if any specific regulations or restrictions apply.

The precise structure allows for clear communication across international borders and assists in the harmonization of product classifications between different countries and regions. As such, businesses must pay close attention to the full HS code, including any country-specific extensions, to ensure accurate classification and compliance.

Tip: When classifying packaging products, consider all elements of the packaging's characteristics - material, purpose, and features that may influence its classification within the HS code structure.

Common Packaging HS Code Categories and Their Meanings

Within the realm of international trade, certain packaging HS code categories are frequently encountered. These categories cover a variety of packaging types, each with its own set of codes that convey specific meanings regarding the product's nature and use. Knowing these categories and their meanings enhances compliance and trade efficiency.

| HS Code Category | Description | Examples |

|---|---|---|

| 3923 | Articles for the conveyance or packing of goods, of plastics | Bottles, containers, drums |

| 4819 | Cartons, boxes, cases, and other packing containers of paper | Carton boxes, packaging cases |

| 4415 | Packing cases, boxes, crates, drums and similar packings of wood | Wooden crates, packing pallets |

| 6305 | Sacks and bags, for the packing of goods | Heavy-duty bags, jute sacks |

| 7607 | Aluminium foil (whether or not printed or backed) | Aluminium packaging foils |

Each category is defined by the material and type of packaging it refers to. For instance, code 3923 specifically relates to plastics, signifying a broad array of plastic packaging goods suitable for storing and transporting products. From this primary category, further subheadings specify details such as the type of plastic or form of packaging.

By familiarizing themselves with these categories, businesses can streamline their classification process, ensure accurate declarations, and avoid misinterpretation that could lead to delays or penalties.

It is important for companies to note that additional digits in the code, as per individual country extensions, could further define the scope of the product, including its particular uses or features.

Remember, packaging plays a dual role in trade · it protects goods during transit and also carries branding and information. Properly categorizing packaging material is not only a regulatory requirement but also impacts the overall presentation and safety of the shipped products.

Navigating the HS Code Directory for Packaging Materials

Navigating the HS Code directory for packaging materials is akin to using a detailed map in the complex landscape of global trade. This directory, structured in a logical and hierarchical manner, helps traders and businesses to classify their packaging materials correctly for customs declaration.

To effectively use the HS Code directory:

- Begin with a clear understanding of your product's attributes, including material composition and intended use.

- Identify the relevant chapter for packaging within the HS Code directory, which usually falls under chapters like 39, 48, or similar, depending on material.

- Scan through the headings and subheadings within that chapter to find the most accurate product classification.

- Consider using online searching tools provided within the directory or on trade information websites that can help you quickly zero in on the correct code.

Many countries offer national online customs databases, which include searchable HS Code directories. These databases may also offer interpretative rules, explanatory notes, and binding tariff information that further clarify classification.

Keep in mind that the details within the HS directory are subject to change due to updates in trade agreements, new product developments, or changes in international regulations. It is essential for businesses to stay current with these updates to avoid compliance issues.

For many, the best approach is a combination of self-research and professional advice, especially when dealing with ambiguous or complex products that do not fit neatly into a single category.

Regardless of the resources used, the end target is to obtain the most precise classification that reflects your product's characteristics and use, ensuring smooth customs processing and accurate tariff applications.

HS Code 39239000: A Closer Look at Packaging Products Classification

Delving into the specific HS code 39239000 provides insight into how packaging products, particularly those made of plastics, are classified for international trade. This code falls under Chapter 39, which is dedicated to plastics and articles thereof, and further narrows down to other articles of plastics not elsewhere specified or included.

Code 39239000 encompasses a vast range of plastic packaging goods such as:

- Protective cases for transport

- Supports or holders for bottles

- Boxes and containers for diverse usage

These packaging products are essential for safe transport and storage, ensuring that goods reach their destination without damage. Understanding this specific HS code helps businesses to categorize their products accurately, which is vital for determining tariffs and adhering to trade regulations.

The classification under code 39239000 could involve various factors including, but not limited to:

- The type of plastic used, such as polyethylene or polystyrene

- The function of the packaging product or the industry it serves

- Whether the product is disposable or intended for long-term use

While the 3923 heading sets a general scope for plastic packaging, the 39239000 code goes further to detail the subcategory of items, providing clarity for customs officials and trade partners alike. Such detailed classification aims to facilitate smooth trade processes and eliminate ambiguity.

Note: A thorough examination of the product's characteristics against the HS code criteria is crucial because inaccurate classification can lead to incorrect duty rates, delays, and potential penalties.

Compliance and Challenges: Using HS Codes for Packaging Exports and Imports

Ensuring compliance when using HS codes for packaging exports and imports is not without its challenges. Adhering to the correct classification requires up-to-date knowledge of the Harmonized System and attention to detail when evaluating your product against the standards set by the World Customs Organization (WCO).

Several challenges are commonly faced by exporters and importers:

- The complexity of a product's design or material composition can make classification ambiguous, needing specialized knowledge.

- Changes in trade agreements and revisions to the Harmonized System could affect previously established classifications.

- Differences in the interpretation of HS codes by various customs authorities can lead to inconsistent classifications.

To mitigate risks and ensure compliance, businesses should adopt strategic measures:

- Conduct regular training and updates for staff on the latest HS classification rules.

- Keep documentation, such as product specifications and previous customs rulings, well-organized for reference.

- Engage with experienced customs brokers or consultants who can provide expert classification services.

- Utilize technology and software solutions that assist in maintaining accurate records and product classifications.

Understanding the implications of the correct HS code for packaging materials directly influences a product's journey across borders. Integral matters such as duty rates, eligibility for trade agreements, and compliance with regulatory requirements hinge on accurate HS code usage.

Staying proactive in managing HS code classifications is not just a legal obligation but also a strategic business practice that can streamline international operations and reduce costs · all while upholding trade integrity.

Updating Your Knowledge: Changes and Updates in Packaging HS Codes

Staying current with changes and updates in packaging HS codes is pivotal for international trade compliance and avoiding disruptions in supply chain operations. The World Customs Organization (WCO) periodically updates the Harmonized System to reflect advancements in technology, changes in international trade practices, and environmental considerations.

Updates to the HS codes can include:

- Addition of new codes for emerging packaging materials or technologies.

- Amendments to existing codes, which may involve splitting a code into more specific categories.

- Clarification of texts to reflect current trade terms, enhancing consistency in product classification.

To ensure that your knowledge remains up-to-date, consider the following actions:

- Regularly review updates published by the WCO and any national customs authority bulletins.

- Subscribe to industry newsletters or join professional trade associations that provide alerts on HS code changes.

- Participate in webinars, workshops, or other educational events focused on trade compliance.

- Maintain open communication with supply chain partners about any relevant changes to codes that may impact shared business operations.

Being proactive in identifying and applying any changes in the Harmonized System not only protects against compliance risks but also demonstrates to customers and customs authorities a commitment to responsible trade practices.

Remember, updates to the HS codes can have a significant impact on tariff rates, market access, and competitive advantage within the global marketplace.

Businesses involved in the export and import of packaging materials should prioritize staying informed and agile in response to code revisions, ensuring seamless trade activities and sustained market presence.

Practical Tips for Accurately Classifying Packaging with HS Codes

For businesses involved in the international shipment of goods, accurately classifying packaging with HS codes is a vital step toward ensuring compliance and efficient customs clearance. Here are some practical tips to help in this critical task:

- Start with a detailed product analysis to gather complete information about the packaging, including material composition, intended use, and any special features.

- Review the current HS code directory and any related explanatory notes for guidance on how to classify your product according to the specified criteria.

- Consider the context and usage of the packaging, as this can sometimes influence the classification more than the material composition itself.

- Look at previous customs entry audits or rulings that could provide precedent for classification decisions related to similar packaging materials.

- Utilize decision-support tools such as cross-reference tables, classification software, and databases that consolidate custom rulings.

When in doubt, seek expert advice:

- Consult with a customs broker or a trade compliance expert. Their expertise in navigating complex classification scenarios can be invaluable.

- Request an official ruling from the customs authorities. This not only provides clarity but can also serve as protection against future classification disputes.

Maintaining good record-keeping practices cannot be overstated. Ensure all classifications, supporting documentation, and decisions are well-documented and readily accessible.

Accuracy in HS code classification is not just about following rules · it's about ensuring that businesses operate smoothly and remain competitive in a global landscape.

In summation, employing a methodical approach to classification, regularly updating knowledge, and seeking professional assistance when needed are key strategies for successful HS code classification of packaging materials.

Avoiding Common Mistakes When Identifying Packaging HS Codes

Mistakes in identifying the correct HS codes for packaging are not uncommon, but they can lead to costly consequences such as delays, fines, and even seizure of goods. To avoid these pitfalls, it is crucial to pay attention to the finer details and exercise due diligence throughout the classification process.

Here are strategies to prevent common errors:

- Avoid making assumptions based on similar product appearances without considering specific material compositions and uses. Packaging that looks alike may have different classifications.

- Do not rely on outdated HS codes as the system undergoes regular updates. Always ensure you are using the most recent version of the HS nomenclature.

- Resist the temptation to default to a "catch-all" code without first exhaustively searching for a more appropriate and precise classification.

- Watch out for over-generalization, which can obscure the unique aspects of the product that might affect its code determination.

Additional steps to ensure accuracy:

- Double-check the entire code, not just the first few digits, to ensure that you have captured the full specificity the code offers.

- Look for binding tariff informa-tion (BTI) decisions, if available in your jurisdiction, which can provide legal certainty about the classification of goods.

- Regularly audit your classifications, especially when introducing new packaging products to your portfolio.

Proper classification is more art than science · involving thoughtful analysis, careful consideration, and sometimes a bit of detective work.

By being meticulous and employing these best practices, businesses can significantly reduce the risk of mistakes when identifying packaging HS codes, thereby ensuring smoother trade operations and compliance.

The Role of TARIC in Understanding Packaging HS Codes

The TARIC (Tarif Intégré de la Communauté) system plays an instrumental role in understanding and applying the correct packaging HS codes, particularly when dealing with trade in the European Union. As an integrated tariff of the European Community, TARIC not only offers all the HS codes in a searchable format but also provides additional EU-specific subcategories and legal notes.

Key features of TARIC that help businesses include:

- Providing EU-specific measures like additional duties, anti-dumping duties, and tariff quotas, which are vital for properly classifying goods at the EU border.

- Integration of all national measures from each EU member state, delivering comprehensive information relevant to importers and exporters within the EU.

- Regular updates on changes in legislation or tariffs that could impact the classification and valuation of packaging materials.

By utilizing TARIC, businesses can:

- Gain access to binding tariff informa-tion (BTI), which are decisions issued by EU customs authorities regarding the classification of goods in the EU.

- Ensure consistent classification by referring to detailed legal notes and guidelines provided in the TARIC database.

- Stay updated on current trade restrictions or protective measures that may affect how packaging materials are classified and managed at EU borders.

TARIC is not just a tool for compliance but also a resource for strategic decision-making regarding the import and export of packaging materials within the EU market.

For businesses navigating the complexities of international trade in packaging, the TARIC system serves as a crucial resource, equipping them with the necessary information to adhere to regulations and optimize their customs processes.

Case Studies: Real-world Examples of Packaging HS Code Application

Examining case studies illuminates the application of packaging HS codes in real-world scenarios, demonstrating the complexities and nuances of proper classification. These examples highlight the importance of accuracy and attention to detail during the classification process.

One such case involved a company exporting biodegradable food containers. Initially, the products were classified under a general plastic goods category. However, upon further research and consultation with trade experts, it was determined that a more specific HS code existed for biodegradable materials, which significantly reduced tariffs under an environmental initiative.

In another instance, a business faced a dilemma while exporting multi-layered insulation foils used in packaging. The confusion arose from the product's composition, which included aluminum, paper, and plastic. The categorization hinged on identifying the material that provided the essential character of the goods. The correct classification was ascertained only after a thorough analysis, factoring in the predominant material by weight and function.

A manufacturer of reusable plastic crates for agricultural produce assumed their containers fell under the general packaging code. Yet, because these crates were designed for multiple uses and long-term handling, they were reclassified under a code for durable plastic goods, subjecting them to different regulations and duty rates.

These case studies reveal that:

- Product classification can directly affect duty rates and access to tariff reductions.

- A detailed understanding of product composition and the concept of essential character is crucial for HS code determination.

- Subtle product features or uses can lead to reclassification under different codes with varying compliance requirements.

Approach HS code classification as a critical decision point with both financial and operational implications · one that merits careful research and professional input.

These real-world examples serve as cautionary tales and educational benchmarks for businesses to follow, ensuring their packaging HS code applications align with global trade best practices.

Conclusion: Mastering Packaging HS Codes for Global Trade Success

In the intricate tapestry of global trade, mastering the correct application of packaging HS codes is more than a compliance exercise · it's a strategic business advantage. A deep understanding of HS codes helps companies navigate international trade with confidence, avoid unnecessary tariffs, and meet regulatory demands effectively.

The crux of success in using packaging HS codes lies in:

- Maintaining a proactive approach to staying informed about updates in the classification system.

- Adopting meticulous record-keeping and validation processes for all imported and exported goods.

- Investing in training and resources to correctly classify goods or engaging with experts who can provide guidance.

- Utilizing tools like TARIC and other customs databases to ensure full compliance with local and international trade regulations.

As we've seen through case studies, even subtle nuances in product composition or intended use can sway classification results, leading to significant financial and operational outcomes.

The mastery of HS codes is not a static goal but a continuous journey · one that demands diligence, adaptability, and respect for the evolving nature of trade.

In closing, businesses that prioritize accurate HS code classification are laying the groundwork for smooth customs clearance, optimizing their logistical efficiencies, and fortifying their global trade practices for long-term success and growth.

Understanding HS Codes for Packaging Materials

What is the HS code for packaging materials?

The HS code for packaging materials varies depending on the specific type of material. For example, HS code 3923 includes articles for the conveyance or packing of goods made from plastics, while HS code 4819 covers paper-based packing containers like cartons and boxes. Each material type has a different category within the HS code structure.

How do I find the correct HS code for my packaging product?

To find the correct HS code for your packaging product, start by consulting the HS code directory from the World Customs Organization. Match your product description with the categories listed in the directory, engage with a customs expert if necessary, and consider past customs rulings. Remember that the first six digits are internationally recognized, but the last four digits can vary by country.

Why are HS codes important for packaging materials?

HS codes are important for packaging materials because they determine the tariffs and taxes applied to a product and ensure compliance with trade regulations. They also facilitate the collection of international trade statistics, aid in risk assessments, and support efficient supply chain management by providing a predictable cost structure for the import and export of goods.

What does the HS code 39239000 refer to in packaging?

HS code 39239000 refers to other articles of plastics, not elsewhere specified or included within Chapter 39 of the HS code directory. This can include a wide array of products, such as plastic cases, supports, holders for bottles, and boxes or containers for various uses that are essential for safe transport and storage of goods.

Are there any common mistakes to avoid when classifying packaging products with HS codes?

Yes, common mistakes include assuming similar-looking products have the same HS code, using outdated codes, selecting a general 'catch-all' code without thorough research, and over-generalizing the product's characteristics. Double-checking for country-specific variations and consulting with customs experts can help to avoid these errors and ensure accurate classification.